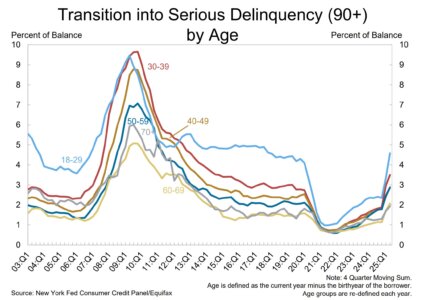

The latest data from the New York Federal Reserve indicate that mortgage delinquencies—loans that are 90 days or more past due—are on the rise again across all age groups. While this may sound alarming at first, it’s actually a sign of the housing market moving back toward a more balanced and historically normal environment

During the pandemic, mortgage forbearance programs allowed millions of homeowners to pause or reduce their mortgage payments. While this provided important relief during an unprecedented time, it also artificially suppressed delinquency rates to near-record lows. In turn, fewer distressed properties came to market, keeping housing inventory extremely tight. This imbalance helped fuel rapid home price growth, often pushing values well above what fundamentals like wages and interest rates would normally support.

Now, with forbearance programs expired and interest rates still elevated, rising mortgage delinquencies are occurring again. But instead of signaling a housing collapse, these numbers reflect a reversion to long-term norms. Historically, a small percentage of borrowers falling 90+ days behind on payments has always been a part of the housing cycle.

As delinquencies normalize, more homes will gradually return to the market, increasing inventory and softening the frenzied price appreciation of recent years. This shift helps buyers by creating more options and better negotiating opportunities, and it helps sellers by keeping the market sustainable rather than overheated.

It’s also worth noting that while lending standards are certainly stronger than they were during the Global Financial Crisis, they remain relatively loose compared to historic norms. Easy access to credit has allowed more borrowers to stretch into higher-priced homes, amplifying affordability challenges. As delinquencies tick upward, this reality underscores how today’s market still faces vulnerabilities, even if they aren’t as severe as the reckless lending practices of the mid-2000s.

For buyers and sellers alike, understanding this transition is key. Rising mortgage delinquencies don’t mean the housing market is in trouble—they mean the market is rebalancing. A healthier mix of supply and demand will set the stage for steadier home price growth and more sustainable real estate opportunities.